[10000印刷√] yield to maturity formula semi-annual coupon 142610-Yield to maturity formula semi-annual coupon excel

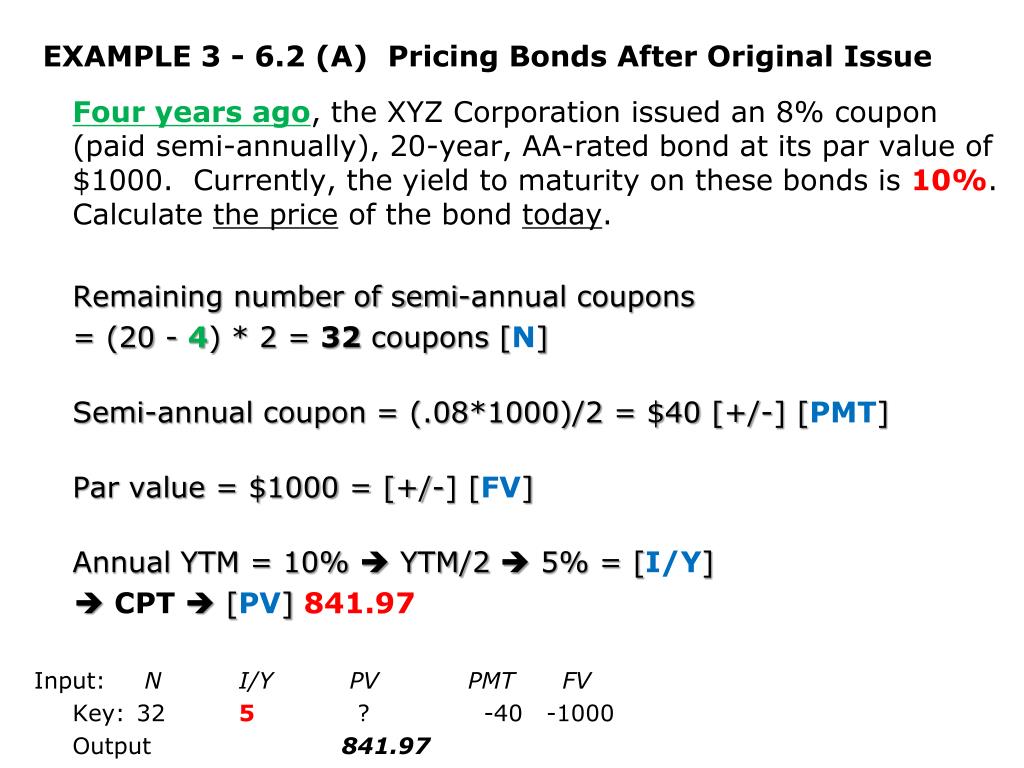

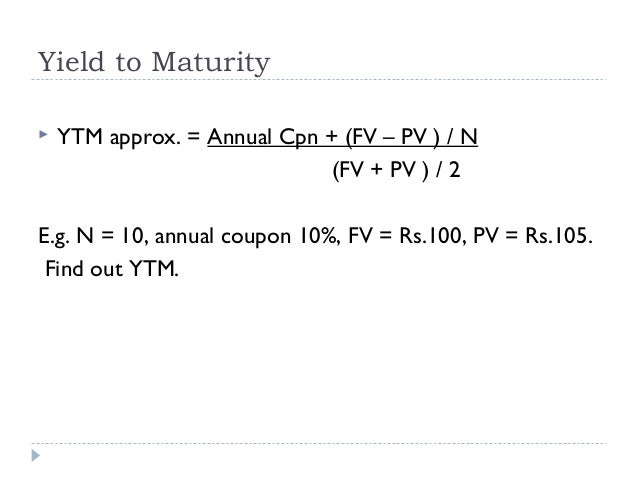

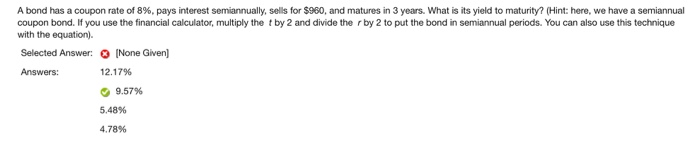

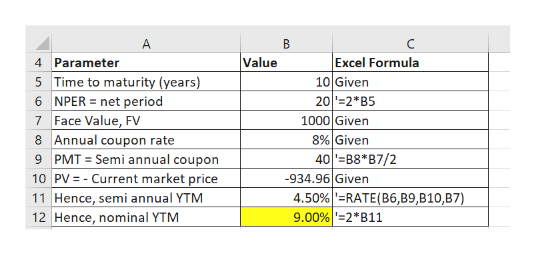

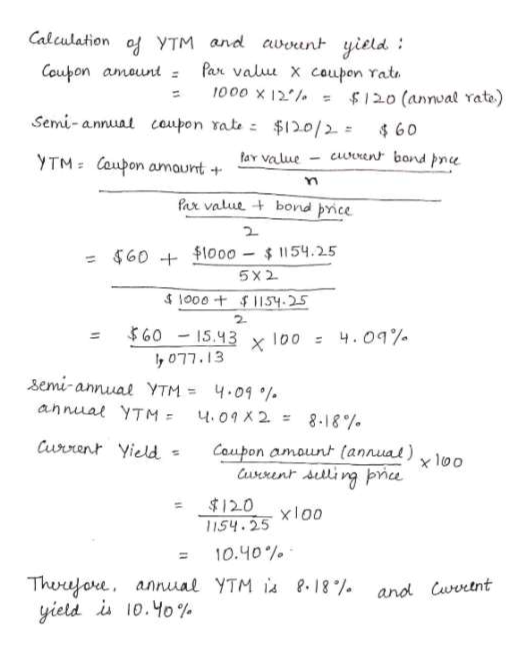

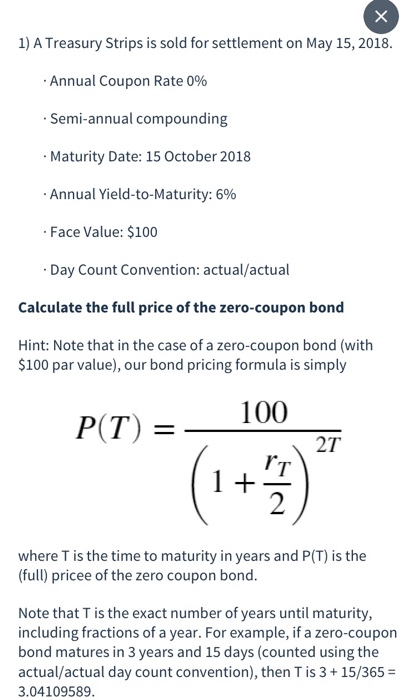

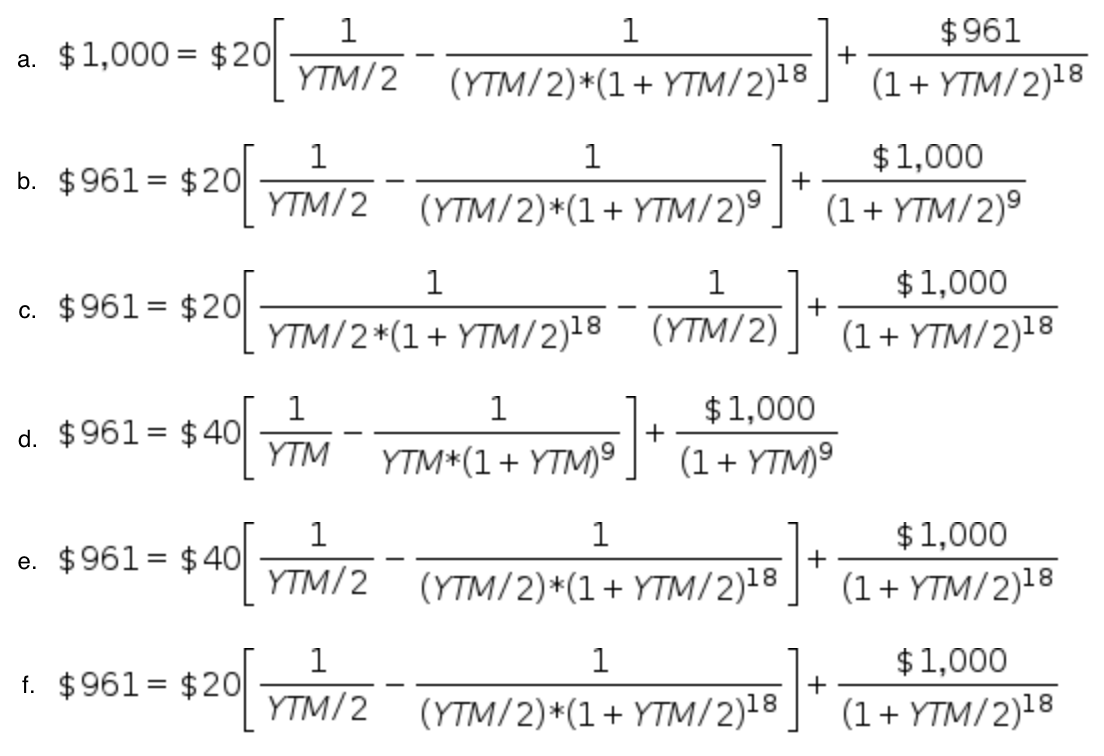

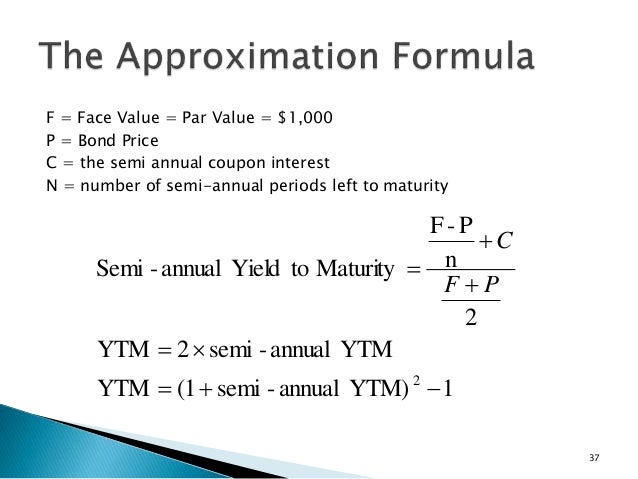

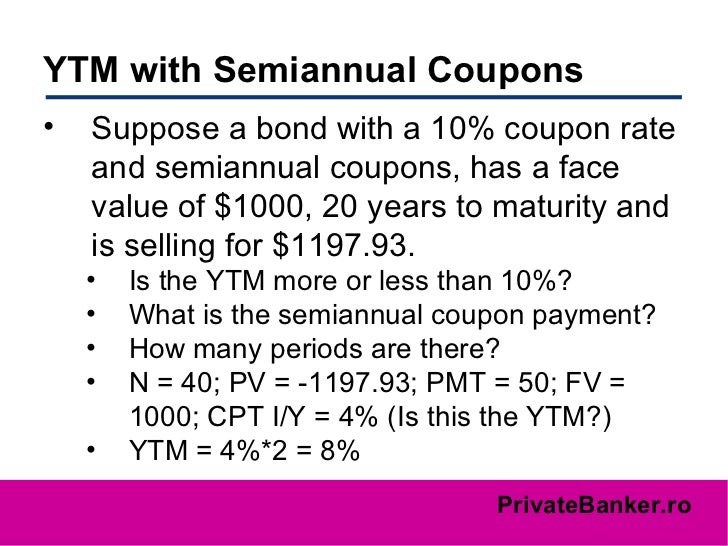

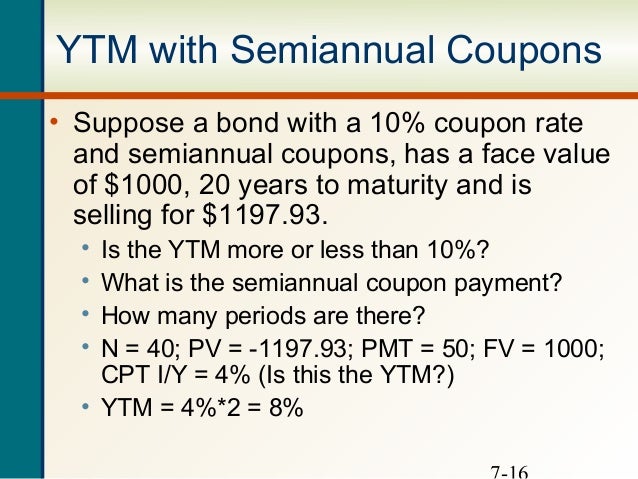

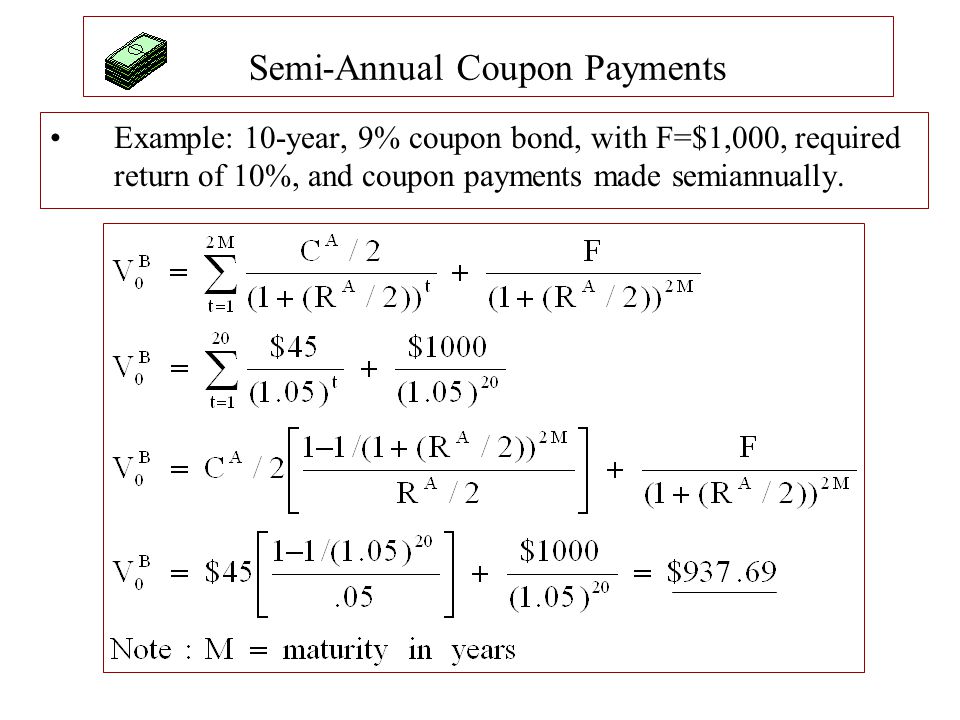

Yield to Maturity (YTM) Definition Formula Method (3 days ago) Semiannual coupon payment = $1,000 × 75% = $75 To calculate the yield to maturity of the bond, we have to use the equation mentioned above To solve this equation, you can use the IRR function of MS Excel as in the figure belowYou can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10Solution for What is the semiannual coupon bond's nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 105% with coupons rate

Http Www3 Nccu Edu Tw Konan Bfm Notes Ch07 6 Pdf

Yield to maturity formula semi-annual coupon excel

Yield to maturity formula semi-annual coupon excel-Its coupon rate is 2% and it matures five years from now To calculate the semiannual bond payment, take 2% of the par value of $1,000, or $, and divide it by two The bond therefore pays $10Years to Maturity 10;

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

An 8000% semiannual coupon corporate bond that matures on 3/15/25, is purchased for settlement on 4/15/21 The yield to maturity is 6333% quoted on a street convention semiannual bond basis (APR 2) Accrued interest is calculated using the 30/360 day count conventionCoupon 9% Maturity date 27 Interest paid semiannually Par Value $1000 Market price $C = the semiannual coupon interest;

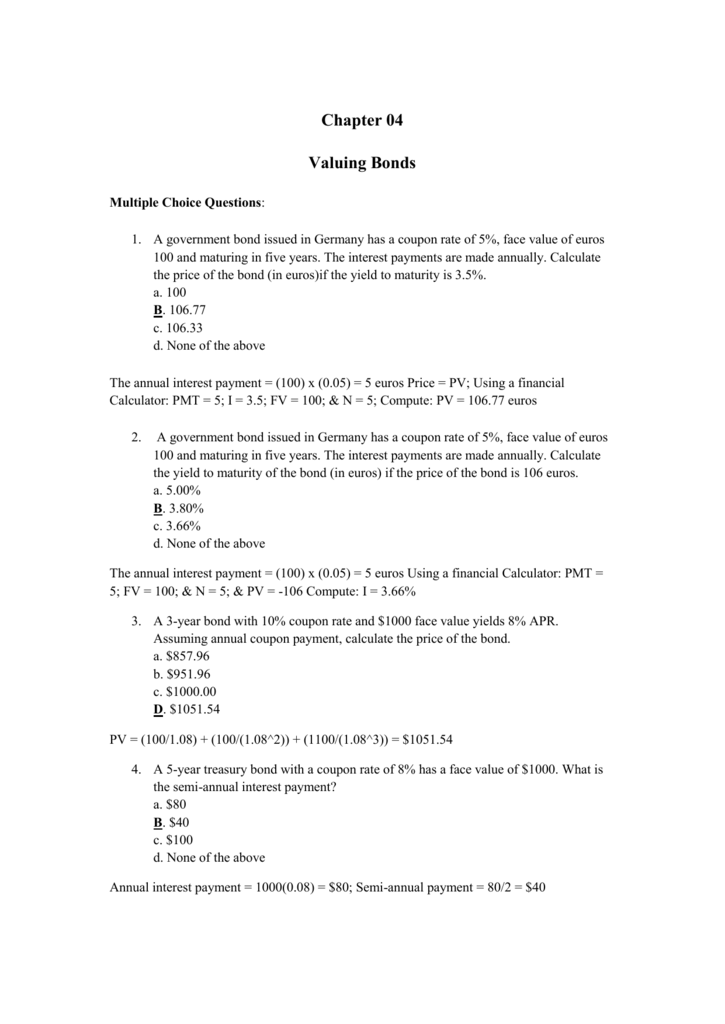

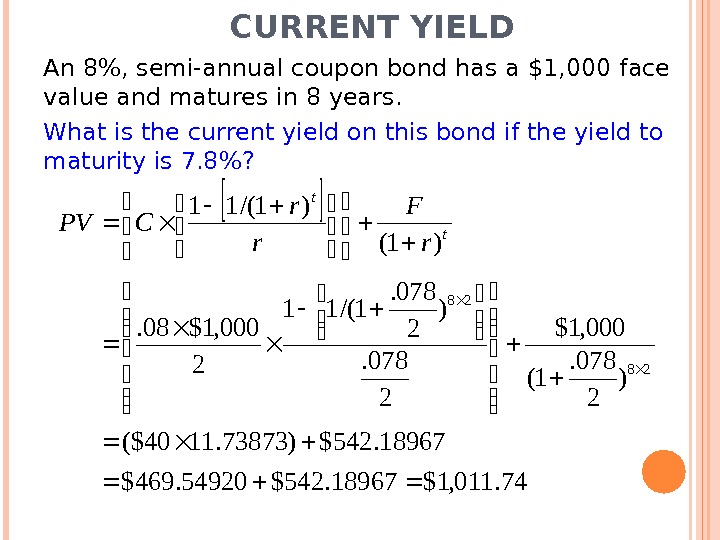

Example of Yield to Maturity Formula The price of a bond is $9 with a face value of $1000 which is the face value of many bonds Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity This example using the approximate formula would beBond Pricing Yield to Maturity Bonds are priced to yield a certain return to investors A bond that sells at a premium (where price is above par value) will have a yield to maturity that is lower than the coupon rate Alternatively, the causality of the relationship between yield to maturity Cost of Debt The cost of debt is the return that aThe bond is currently priced at a discount of $9592, matures in 30 months, and pays a semiannual coupon of 5% Therefore, the current yield of the bond is (5% coupon x $100 par value) / $9592

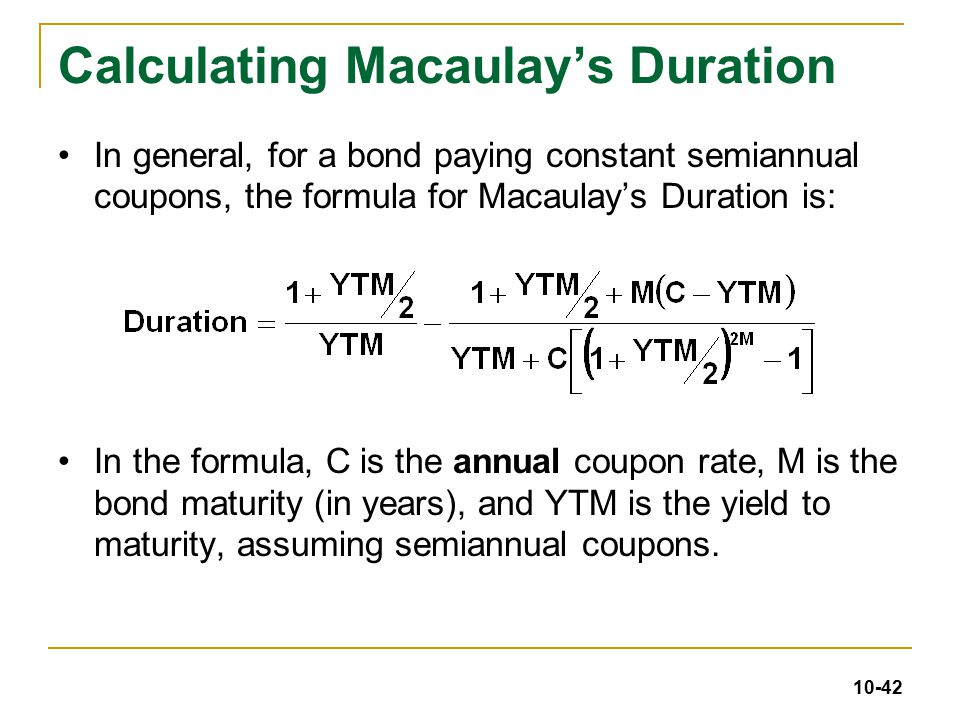

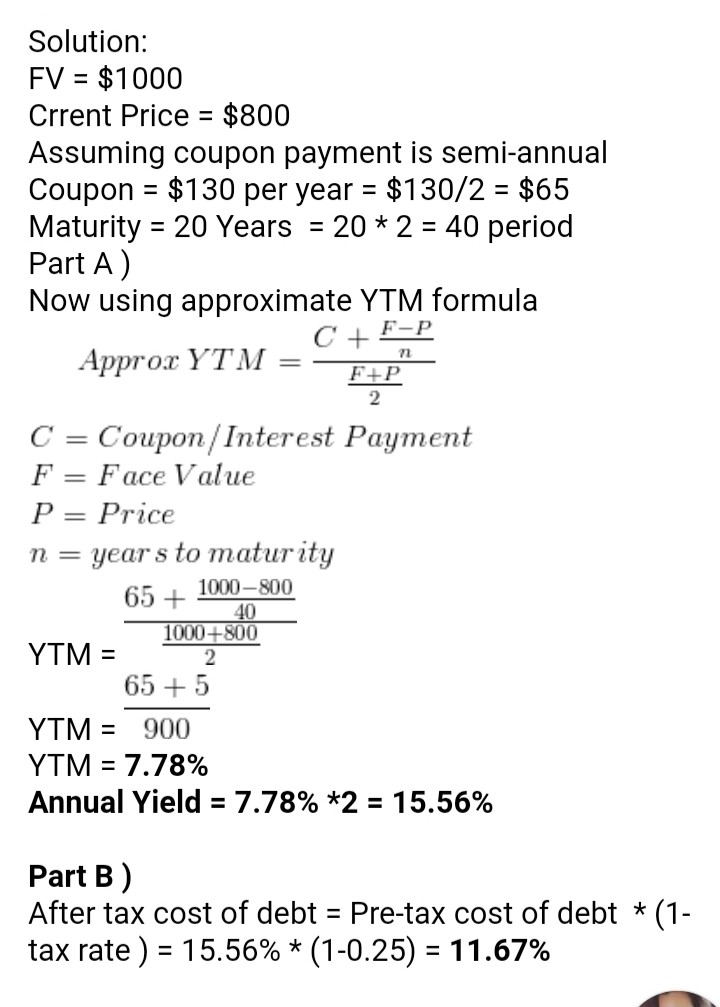

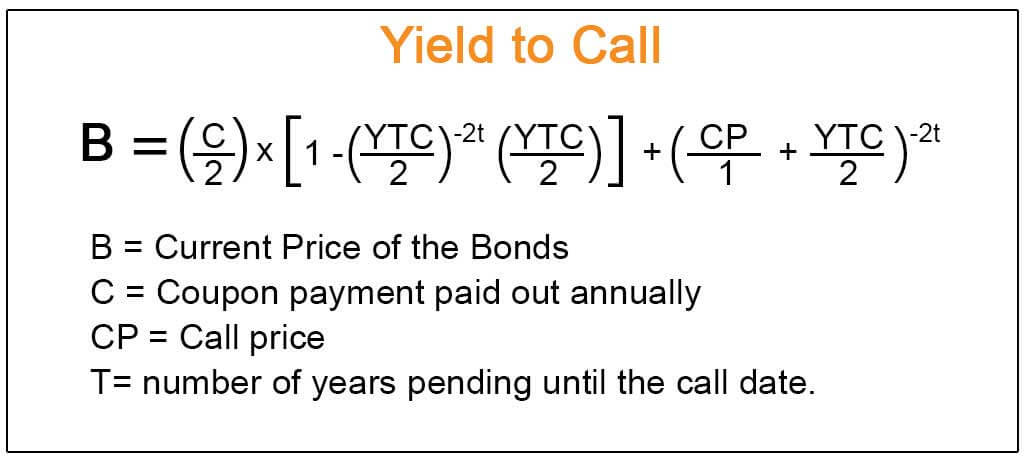

100 ( ( 1000 9 ) / 10) / ( 1000 9 ) / 2 = 100 8 / 960 = 1125% What's the Exact Yield to Maturity Formula?Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 yearsPart A) Find the Yield to maturity of a bond that has a semiannual coupon of 8% and is currently selling for $1,240 The bond has years left to mature Par value = $1000 Part B) A Callable bond is currently selling for $1,150 The bond pays a coupon of 8% (paid semiannually) The bond is callable in 5 years for $1,040

Ppt Chapter 6 Powerpoint Presentation Free Download Id

Yield To Maturity Ytm Calculator

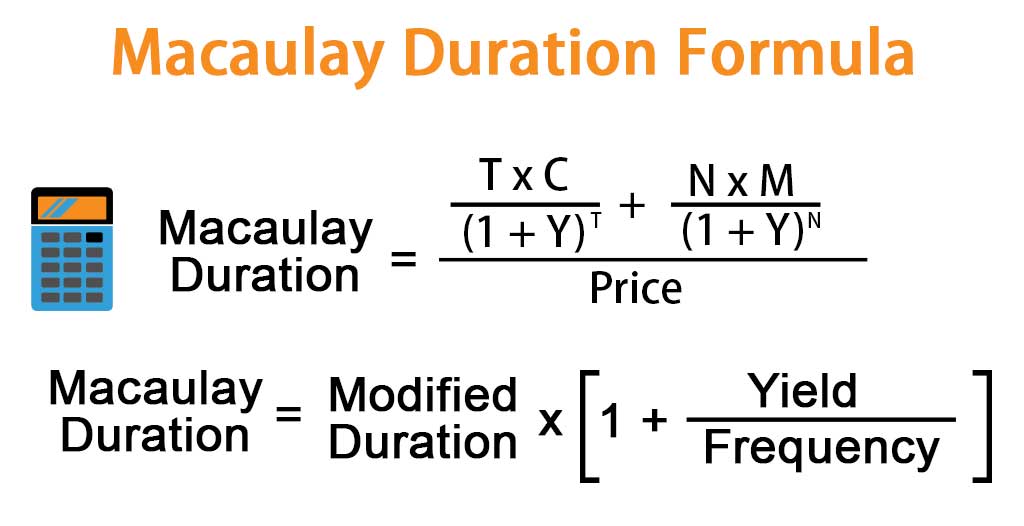

In this lesson, you will learn what yield to maturity is, discover the formula for calculating it, and see some examples of how the formula works and what it reveals about investmentsThe calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Bond Duration Calculator Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present ValueTo calculate the semiannual bond payment, take 2% of the par value of $1,000, or $, and divide it by two The bond therefore pays $10 semiannually Divide $10 by $900, and you get a semiannual

Assume That A Par Value Semiannual Coupon Government Of Canada Bond With 3 Years To Homeworklib

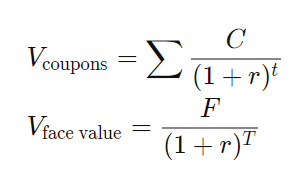

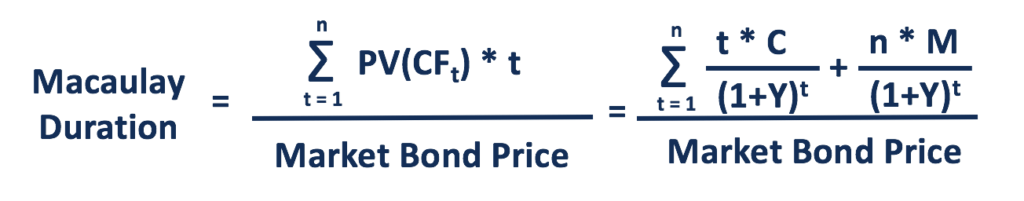

Macaulay Duration Formula Example With Excel Template

The calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2 https//wwwmybestcouponcodescom/zerocouponbondcalculatorsemiannual/The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date It is the sum of all of its remaining coupon payments AYield To Maturity Formula Semi Annual Coupon, mobile freebies, deals in hutchinson ks, chuy's cincinnati coupons Show Coupon 🔥 Trending Deals Get Free In Store, Grocery, Local, and Online Coupons

Understand Term Structures Interest Rates And Yield Curves

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

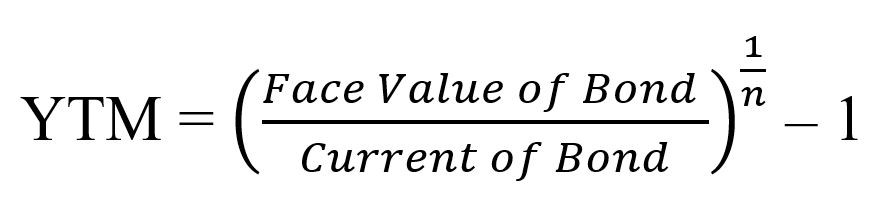

The calculator, uses the following formula and methodology to compute the yields Current Yield = (Face Value * Coupon Rate / 100) / Current Value Yield to Maturity is calculated using a Javascript implementation of the Excel RATE function Related Calculators Bond Convexity CalculatorThe formula for calculating YTM is as follows Let's work it out with an example Par value (face value) = Rs 1,000 / Current market price = Rs 9 / Coupon rate = 10%, which means an annual coupon of Rs 100 / Time to maturity = 10 years Taking the above example and using the formula, the YTM would be calculated as followsCalculating Yield to Maturity on a Zerocoupon Bond YTM = (M/P) 1/n 1 variable definitions YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value;

Modified Duration

What Is Coupon Rate In Bonds Know More Fincash Com

The yield to maturity (YTM), book yield, or redemption yield of a bond or other fixedincome asset, such as a bond, is based on the assumption or understanding that an investor buys the security at the current market price and keeps it until the security has matured (reaches its maximum value), and that all interest and coupon payments are made on timeThe yield to maturity (YTM), book yield, or redemption yield of a bond or other fixedincome asset, such as a bond, is based on the assumption or understanding that an investor buys the security at the current market price and keeps it until the security has matured (reaches its maximum value), and that all interest and coupon payments are made on timeYield To Maturity Formula Semiannual Coupon Overview Yield To Maturity Formula Semiannual Coupon can offer you many choices to save money thanks to 10 active results You can get the best discount of up to 50% off The new discount codes are constantly updated on Couponxoo The latest ones are on Feb 14, 21

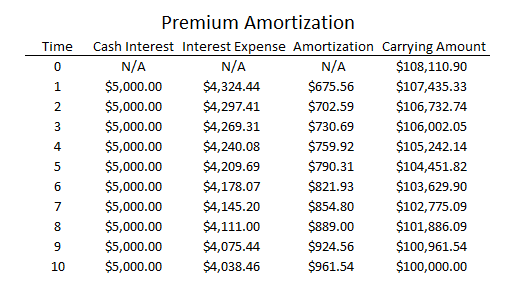

How To Calculate Interest Expenses On A Payable Bond The Motley Fool

Bond Yield Calculator

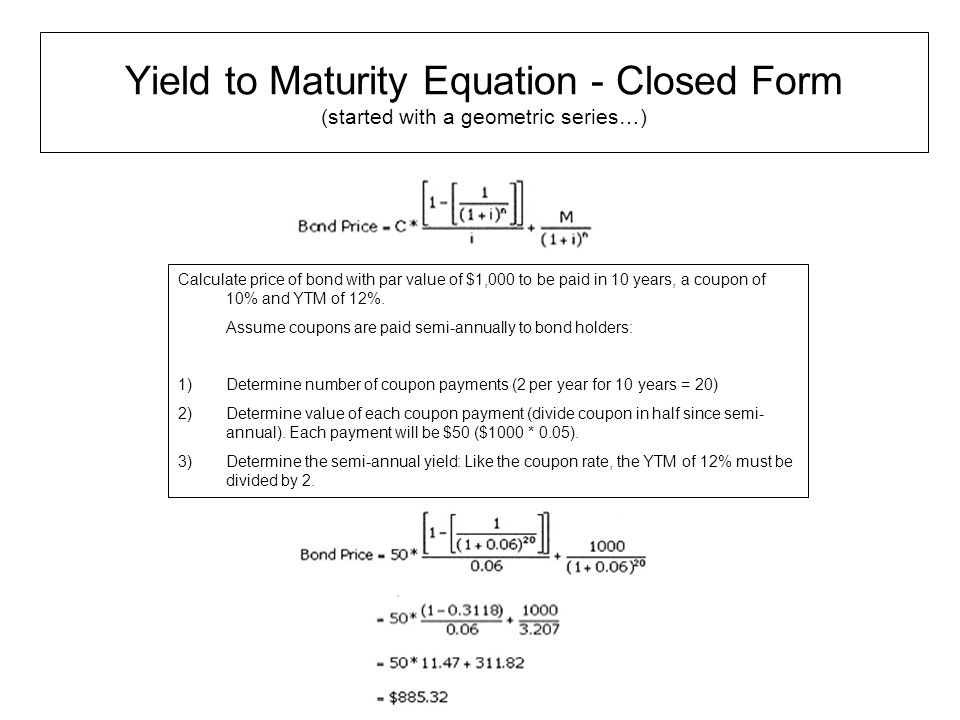

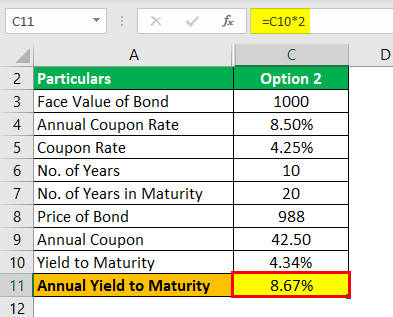

Coupon on the bond will be $1,000 * 850% / 2 which is $425, since this pays semiannually Yield to Maturity (Approx) = (4250 (1000 – 9) / (10 * 2))/ ( ( 1000 9 )/2) Yield to Maturity will be –COUPON (2 months ago) (16 days ago) (17 days ago) semi annual coupon rate formula (1 months ago) How to Calculate SemiAnnual Bond Yield The Motley Fool CODES Get Deal Its coupon rate is 2% and it matures five years from now To calculate the semiannual bond payment, take 2% of the par value of $1,000, or $, and divide it by twoYield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market price

Yield To Maturity Formula Step By Step Calculation With Examples

Quant Bonds Between Coupon Dates

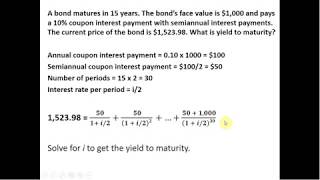

The yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on schedule(17 days ago) semi annual coupon rate formula (1 months ago) How to Calculate SemiAnnual Bond Yield The Motley Fool CODES Get Deal Its coupon rate is 2% and it matures five years from now To calculate the semiannual bond payment, take 2% of the par value of $1,000, or $, and divide it by twoReturn will equal the yield to maturity calculation on the day you purchased the bond 4 Assume the government issues a semiannual pay bond that matures in 5 years with a face value of $1,000 and a coupon yield of 10 percent (a) What price would you be willing to pay for such a bond if the yield to maturity (semiannual compounding) on similar 5year governments were 8%?

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Http Kevinx Chiu Weebly Com Uploads 8 9 8 3 380 Homework 3 Solutions Pdf

Divide $10 by $900, and you get a semiannual bond yield of 11% Is coupon rate and interest rate the same?The yield to maturity (YTM), book yield, or redemption yield of a bond or other fixedincome asset, such as a bond, is based on the assumption or understanding that an investor buys the security at the current market price and keeps it until the security has matured (reaches its maximum value), and that all interest and coupon payments are made on timeYou can use Excel's RATE function to calculate the Yield to Maturity (YTM) Check out the image below The syntax of RATE function RATE (nper, pmt, pv, fv, type, guess) Here, Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10

Sol Coupon Ext Answers For Antonio Tutorial Excerises Studocu

How To Calculate Bond Price In Excel

Talk the annual interest rate up by one more point to 7 percent (or 35 percent on a semiannual basis) Plug it into the formula, and you get a P of $95 This is too low, but you now know that the precise yield to maturity is somewhere between 6 and 7 percent or between 3 and 35 percent on a semiannual basisAnnual Coupon Rate 10%;(3 days ago) Coupon Rate = (Coupon Payment x No of Payment) / Face Value Note n = 1 (If Coupon amount paid Annual) n = 2 (If Coupon amount paid SemiAnnual) Coupon percentage rate is also called as the nominal yield In other words, it is the yield the bond paid on its issue date

Hp 10bii Financial Calculator Bond Calculations

Yield To Maturity Ytm Overview Formula And Importance

N = number of semiannual periods left to maturity;An 8000% semiannual coupon corporate bond that matures on 3/15/25, is purchased for settlement on 4/15/21 The yield to maturity is 6333% quoted on a street convention semiannual bond basis (APR 2)Accrued interest is calculated using the 30/360 day count conventionWhat is the yield to maturity of the following bond?

Introduction To Bonds Fixed Income Security Slideshow And Powerpoint Viewer Bonds Fixed Maturity Exception Consols Which Never Mature Fixed Income From Periodic Interest Princi

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Definition of 'Coupon Rate' Definition Coupon rate is the rate of interest paid by bond issuers on the bond's face value The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or faceIf you've already tested the calculator, you know the actual yield to maturity on our bond is % How did we find that answer?= Yield to Maturity (YTM) To calculate a bond's yield to maturity, enter the face value (also known as "par value"), the coupon rate, the number of years to maturity, the frequency of payments, and the current price of the bond Example of Calculating Yield to Maturity For example, you buy a bond with a $1,000 face value and 8% coupon for $900

How To Calculate Bond Price In Excel

How To Calculate Interest Expenses On A Payable Bond The Motley Fool

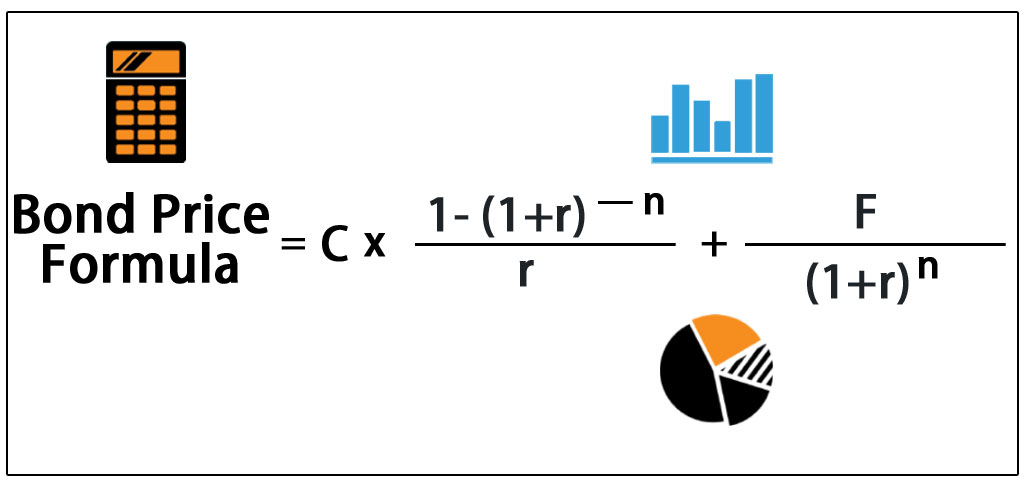

Coupon Frequency 2x a Year;The algorithm behind this bond price calculator is based on the formula explained in the following rows Where F = Face/par value c = Coupon rate n = Coupon rate compounding freq (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No of years until maturityFREE Semi Annual Coupon Rate (7 days ago) 80% OFF semi annual coupon rate formula Verified (6 days ago) The bond makes semiannual coupon payments, and the yield to maturity is 6% The semiannual coupon is $40, the semiannual yield is 3%, and the number of semiannual periods is four The bond's price is determined as follows

Valuing Bonds Boundless Finance

21 Cfa Level I Exam Cfa Study Preparation

The calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2To calculate the semiannual return rate of your bonds, you can utilize a series of simple calculations These include dividing the annual coupon rate in half, calculating the total number of compounding periods, and multiplying the bond's current face value by the semiannual interest rate in order to determine the semiannual payment amountCalculate Yield To Maturity Coupon Bond Semiannual (5 days ago) Yield to Maturity Formula Step by Step Calculation with (4 days ago) Yield to Maturity (Approx) = 443% This is an approximate yield on maturity, which shall be 443%, which is semiannual

Ytm Formula Excel

Chapter 05

Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowN = years until maturity;Solution for What is the semiannual coupon bond's nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 105% with coupons rate

Yield Function Formula Examples Calculate Yield In Excel

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

P = C× (1 r) 1 C× (1 r) 2 C× (1 r) Y B× (1 r) Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturityMathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n C/ (1YTM)i P/ (1YTM)n Coupon Bond = C * 1 (1YTM)n/YTM P/ (1YTM)n where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No of periods till maturityThe coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to Maturity

Bond Valuation Overview With Formulas And Examples

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Solution for What is the semiannual coupon bond's nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 105% with coupons rate(9 days ago) Coupon Rate = (Coupon Payment x No of Payment) / Face Value Note n = 1 (If Coupon amount paid Annual) n = 2 (If Coupon amount paid SemiAnnual) Coupon percentage rate is also called as the nominal yield In other words, it is the yield the bond paid on its issue dateYield to Maturity = 429 % CALCULATE CALCULATE

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

Bond Valuation

Yield To Maturity Fixed Income

Bond Pricing Formula How To Calculate Bond Price

Macaulay Duration Overview How To Calculate Factors

How To Calculate Pv Of A Different Bond Type With Excel

Web Iit Edu Sites Web Files Departments Academic Affairs Academic Resource Center Pdfs Macaulay Duration Pdf

How To Use The Excel Mduration Function Exceljet

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Bond Discounting I Types I Examples I Formula I Bonds Valuation

Yield To Maturity Approximate Formula With Calculator

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Solved A Bond Has A Coupon Rate Of 8 Pays Interest Semi Chegg Com

7 Interest Rates And Bond Valuation Fin 311

Yield To Maturity Formula Step By Step Calculation With Examples

An Introduction To Bonds Bond Valuation Bond Pricing

Yield To Maturity Formula Ppt Download

Http Burcuesmer Com Wp Content Uploads 15 10 Bond Valuation Pdf

Answered A Bond Has An Annual 8 Percent Coupon Bartleby

Yield To Maturity Formula Step By Step Calculation With Examples

A 10 Year Maturity Bond With Par Value Of 1 000 Makes Semiannual Coupon Payments At A Coupon Homeworklib

How To Calculate Pv Of A Different Bond Type With Excel

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

Answered Ezzell Enterprises Noncallable Bonds Bartleby

Solved Valuing Semiannual Coupon Bonds Bonds Often Pay A Chegg Com

Www Unm Edu Maj Investments Ps12 sol Pdf

Calculate The Coupon Rate Of A Bond Youtube

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

Bond Yield Calculator

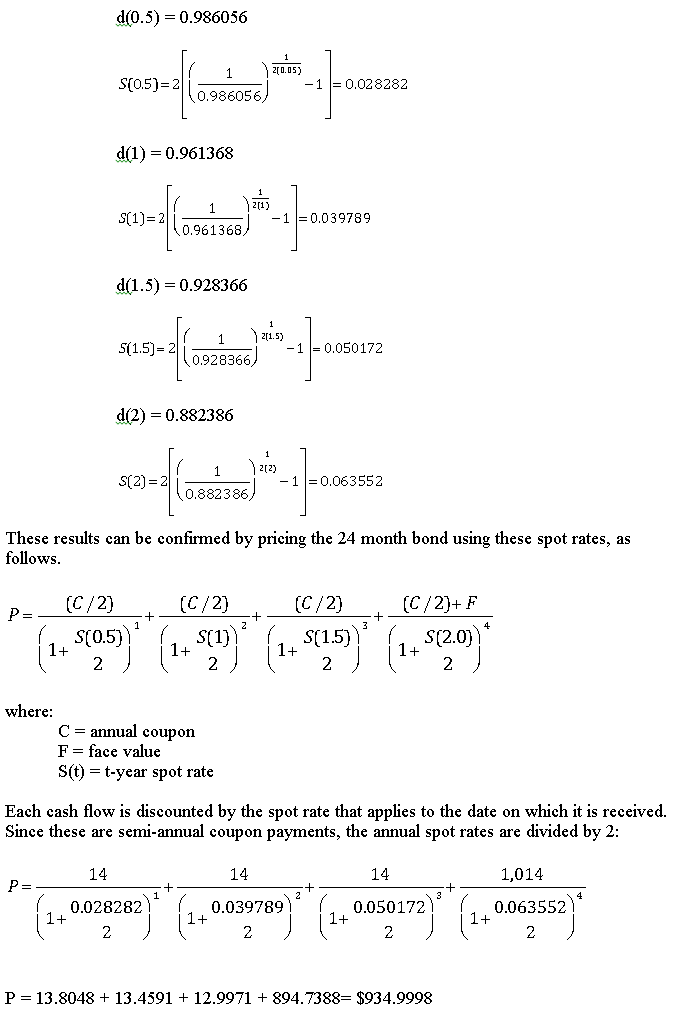

Solved H 1 A Treasury Strips Is Sold For Settlement On M Chegg Com

Finding Coupon Rate Of A Coupon Bond 6 3 3 Youtube

How To Calculate Yield To Maturity 9 Steps With Pictures

Solved Apparently This Is Not The Correct Answer So Pleas Chegg Com

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Ytm Definition Formula And Example

Microsoft Excel Bond Valuation Tvmcalcs Com

Zero Coupon Bond Yield Formula With Calculator

How To Calculate Bond Price And Yield To Maturity Pdf Free Download

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

Suppose A Ten Year 1 000 Bond With An 8 1 Coupon Rate And Semi Annual Coupons Is Trading For Homeworklib

Bond Yield Calculator

Term Structure Of Interest Rates Tutorials The Middle Road

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Pricing Formula How To Calculate Bond Price Examples

Ytm Equation Photos Download Jpg Png Gif Raw Tiff Psd Pdf And Watch Online

Http Www3 Nccu Edu Tw Konan Bfm Notes Ch07 6 Pdf

Pricing Bonds With Different Cash Flows And Compounding Frequencies Fidelity

Yield To Maturity Formula Step By Step Calculation With Examples

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

1

Chapter 6 Bonds Flashcards Quizlet

What Is Yield To Maturity How To Calculate It Scripbox

Module 52 Intro To Fixed Income Valuation Flashcards Quizlet

Bond Formula How To Calculate A Bond Examples With Excel Template

Solved 9 Year 4 Semi Annual Coupon Bond With 1 000 Fa Chegg Com

You Own A Bond That Pays A 12 Annualized Semi Annual Coupon Rate The Bond Has 10 Years To Maturity If The Discount Rate Suddenly Moves From 14 To 16 Then What Is

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Security Valuation Bonds Updated

Web Iit Edu Sites Web Files Departments Academic Affairs Academic Resource Center Pdfs Macaulay Duration Pdf

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Calculate The Ytm Of A Coupon Bond Youtube

Q Tbn And9gctmjjcknhq5z6xqz1cb0 Ujolevox3tjfw K1tbrzk W Ikim Usqp Cau

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Quant Bonds Between Coupon Dates

Bond Valuation

Interest Rates And Bond Evaluation By Junaid Chohan

Cost Of Debt Definition Formula Calculation Example

How To Use The Excel Yield Function Exceljet

Chapter 2 Bond Value And Return Ppt Video Online Download

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

コメント

コメントを投稿